Gabi's passionate about creating content that inspires. Her work history lies in writing compelling website copy and content, and now specialises in product marketing copy. When writing content, Gabi's priority is ensuring that the words impact the readers. As the voice of Osome's products and features, Gabi makes complex business finance and accounting topics easy to understand for small business owners.

If you’re trying to understand what a Singapore tax identification number is, look no further. Whether for individuals or businesses, a TIN is essential for compliance with tax laws and seamless financial operations. This concise article will explain the Singapore tax identification number, why it's needed by the Inland Revenue Authority, how to identify yours, and its role in your tax dealings — providing the clarity you need without unnecessary complexity.

The Tax Identification Number (TIN) in Singapore is a unique set of nine to ten digits. It is issued by the government to tax-paying individuals and entities. This number serves as a distinct identifier in tax filing procedures and financial transactions. Far from being a random set of digits, the Singapore tax identification number plays a significant role in legal tax compliance, efficient record-keeping, and streamlined tax processes for all taxpayers. Whether you’re a citizen, a permanent resident, or a business entity, you’re assigned a unique tax identification number in Singapore, making tax monitoring and identification of discrepancies smooth sailing.

Fundamentally, the Singapore tax identification number is a vital identifier for tax-related activities in the country, unlocking the door to streamlined tax compliance and administrative processes. But who issues a tax identification number in Singapore, and what form do they take for different individuals and entities? We'll break it down for you.

By the way, for those looking to establish their business presence in Singapore, our expert company incorporation services for foreigners can help ensure a smooth and compliant setup.

When it comes to tax-related matters in Singapore, the Inland Revenue Authority of Singapore (IRAS) takes centre stage. As the government agency responsible for tax administration, IRAS is the official issuer of TINs in Singapore. For Singapore citizens and permanent residents, the TIN takes the form of a Tax Reference Number (TRN) assigned by the IRAS.

Imagine the TRN as a unique tax fingerprint, helping the IRAS identify each taxpayer in the ocean of tax-related transactions.

Assigning Tax Reference Numbers (TRNs) to a Singapore citizen and permanent resident is done using their National Registration Identity Card (NRIC). The NRIC serves as an identification number in Singapore, aligning with the TRN, for citizens and long-term residents.

The moment you turn 15 or become a resident of Singapore, you’re automatically assigned a TIN – your NRIC number. This number becomes your tax identity, helping you navigate the tax system in Singapore.

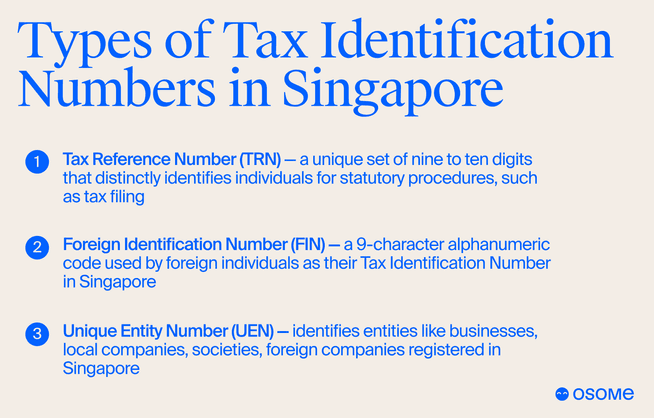

Related Guide Your Go-to Guide to Setting a Business in Singapore as a ForeignerAfter understanding the fundamentals of the Singapore tax identification number, we will dive deeper into the different types of TINs assigned to various entities. In Singapore, TINs are not one-size-fits-all; they come in different forms depending on the entity they’re assigned to. The primary Tax Identification Number (TIN) for Singapore citizens and permanent residents is the National Registration Identity Card (NRIC) number. This number is used for tax-related matters and other official documentation. For foreign individuals, it’s the Foreign Identification Number (FIN).

What about business entities? They’re identified by theUnique Entity Number (UEN), which serves as their primary TIN. Their UEN must be obtained from a government body such as the Accounting and Corporate Regulatory Authority (ACRA). The UEN replaced the TRN system back in January 2009, becoming the standard identifier for a range of entities, including:

These TINs, whether NRIC/FIN for individuals or UEN for businesses, consist of specific alphanumeric combinations. For instance, the UEN format depends on factors such as the entity type, year of issuance, and issuing agency. However, understanding each type of TIN more closely will help you appreciate their unique roles and structures.

We begin with the Income Tax Reference Number (TRN), a unique set of nine to ten digits that distinctly identifies individuals for statutory procedures, such as filing taxes. For Singapore citizens and permanent residents, the TRN is typically the same as their NRIC number. The tax reference number assigned to an individual is interesting in its first character: if you’re a Singaporean citizen or resident born before 2000, your TRN will start with an “S”, while those born in or after 2000 will have a TRN starting with a “T”. This system provides a clear and organised way of tracking taxpayers and managing tax-related activities.

Next is the Foreign Identification Number (FIN), a 9-character alphanumeric code used by foreign nationals as their Singapore Tax Identification Number (TIN). If you’re a foreigner residing in Singapore with a valid work permit or another type of long-term pass, you’re eligible to be assigned a FIN as your TIN.

Issued by the Immigration and Checkpoints Authority (ICA) and reflected on work passes and other long-term passes provided by the Ministry of Manpower (MOM), each FIN is unique to the individual to whom it is assigned, serving as an identifier for tax and other government-related services.

For business bodies, the Unique Entity Number (UEN) takes centre stage. This number identifies entities like:

Unlike individuals who obtain TINs from IRAS, local and foreign companies obtain their Unique Entity Number (UEN) through various government agencies in Singapore.

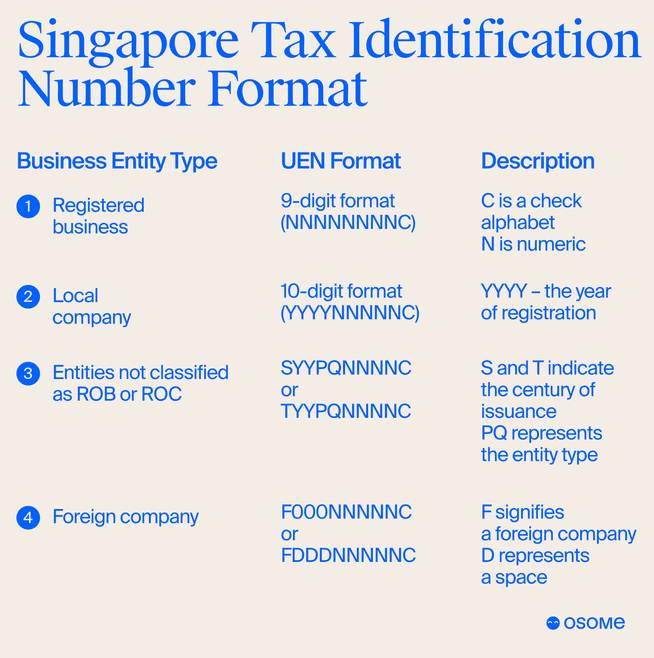

The UEN format depends on the entity type, with businesses having a 9-digit format, local companies a 10-digit format, and other entities a 10-digit format with identifiers indicating type and year of issuance. Thus, the UEN not only identifies businesses but also provides information about their registration and type.

Comprehensive company incorporation

Incorporate your company and get an Osome corporate secretary to ensure you comply with laws and regulations from the get-go.

Having examined the different types, we shall now have a look at the structure of Singapore's tax identification number varieties. The format of Singaporean TINs, for both individuals and businesses, hinges on unique circumstances and alphanumeric combinations.

Individual TINs in Singapore, whether they’re TRNs or FINs, share the same structure, which is in the format #0000000@. The first character can be “S”, “T”, “F”, “G”, or “M” depending on the status of the holder. The seven digits following the first character are serial numbers assigned to the individual. The last character of an individual TIN is a checksum alphabet.

This structure provides a systematic way of assigning TINs to individuals based on their status and identity.

The Singapore tax identification number (TIN) for business entities, also known as the UEN, is a nine or ten-digit alphanumeric identifier. The UEN varies based on factors, including entity type, year of issuance, and the agency issuing the UEN. For example, a registered business has a 9-digit format (NNNNNNNNC). A local company’s UEN follows a 10-digit format (YYYYNNNNNC), where YYYY denotes the year of registration. For entities not classified as ROB or ROC, the UEN format includes an entity type code, such as SYYPQNNNNC or TYYPQNNNNC, where S and T indicate the century of issuance and PQ* represents the entity type.

Foreign company UENs follow the format F000NNNNNC or FDDDNNNNNC, where F signifies a foreign company and D represents a space. This structure provides a clear and organised way of tracking and managing established businesses.

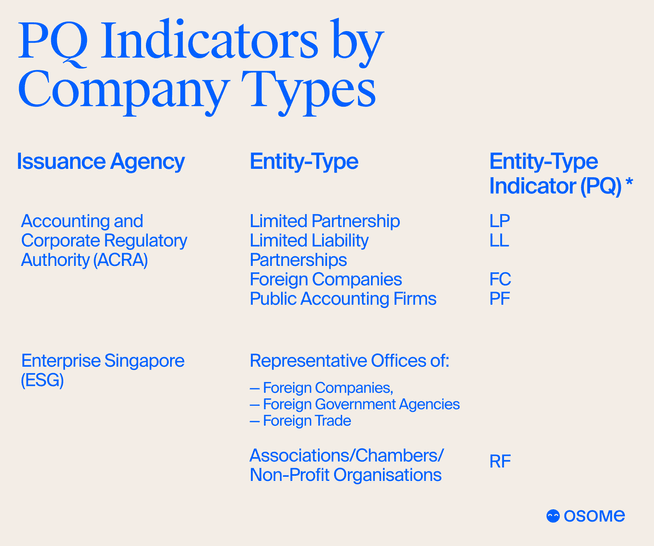

*PQ corresponds to business entity types and can fall into one of the categories presented in the table below.

Examples of the TIN numbers by business types:

After understanding what a TIN is, its various types, and their formats, the next question is, naturally, how does one obtain it?

The process of obtaining a TIN in Singapore varies for individuals and businesses.

For individuals, the application for a Singapore Tax Identification Number starts with an IRAS Unique Account or SingPass. Singapore citizens must provide their National Registration Identity Card Number, while foreigners should provide their Foreign Identification Number when applying for a TIN. After the submission and review process, the Tax Reference Number is issued within five working days.

On the other hand, businesses need to register with the Accounting and Corporate Regulatory Authority of Singapore (ACRA) to acquire a Unique Entity Number (UEN) as their tax identification number. When the registration process is complete, ACRA issues a Certificate of Incorporation, which includes the UEN. Once obtained, the UEN acts as a permanent identifier for the entity and is critical for engagement with various government agencies, financial institutions, and other stakeholders. It does not require periodic renewal.

In Singapore, a tax identification number extends beyond being a mere number on paper; it fulfils a significant role in transactions with numerous financial institutions and compliance requirements. Both individuals and businesses are required to use their Tax Identification Number for filing taxes and to access tax-filing services online.

The TIN is also used for a range of government transactions, such as remitting Central Provident Fund (CPF) payments.

When opening a bank account in Singapore, necessary documents include NRIC or government-issued tax documents displaying income tax filings, which inherently contain the individual’s TRN. These documents must be within three months of the application date, and the details must match the information given on the bank account application form.

Open a bank account in Singapore

We bridge the gap between you and our banking partners. Separate business and personal finances with our assistance.

For businesses engaged in trade, a tax identification number is required to obtain import and export permits to tax foreign income or expenses.

The Unique Entity Number (UEN) serves as the TIN for businesses and is required for filing corporate tax returns or applying for import/export permits.

The tax identification number system in Singapore is also pivotal in financial compliance. The Foreign Identification Number (FIN) enables the government to monitor and ensure that taxpayers are meeting their tax obligations while residing in Singapore.

When making Central Provident Fund (CPF) contributions, businesses must declare TINs for themselves and their employees to facilitate the government’s tracking and taxation of CPF transactions.

Related Guide What Is Financial Reporting and Why Is It Important?Having learned the mechanics of Singapore’s TIN, we can now discuss some best practices for its efficient management. These practices can help individuals and businesses maintain accurate documentation, regularly check tax records, and stay informed on tax laws.

Accurate documentation is the cornerstone of financial compliance and maintaining proper records for tax-filing purposes. Companies in Singapore are required to keep proper financial records for at least five years from the relevant Year of Assessment.

Having good record-keeping practices enables companies to stay aware of their financial status and supports sound business decision-making.

Regularly checking tax records is also crucial to ensure their accuracy and to identify and rectify any discrepancies as soon as possible. Keeping systematic accounting records and being able to explain all transactions is essential; bank statements alone are not sufficient for record-keeping.

It’s also advisable to adopt electronic record-keeping systems to reduce manpower costs and enhance the tracking of business transactions.

In the ever-evolving financial landscape of Singapore, staying informed on tax laws and tax-related matters is paramount. This will not only help you stay compliant but also take full advantage of available benefits or deductions.

Regular updates to the list of participating jurisdictions for the Common Reporting Standards (CRS) directly affect the reporting and due diligence duties of businesses in Singapore.

In this journey through the tax landscape of Singapore, we’ve unravelled the concept of the Tax Identification Number (TIN), its different types, formats, and usage. We’ve also discussed how to acquire a tax identification number and some best practices for managing it.

Gabi Bellairs-Lombard Business WriterGabi's passionate about creating content that inspires. Her work history lies in writing compelling website copy and content, and now specialises in product marketing copy. When writing content, Gabi's priority is ensuring that the words impact the readers. As the voice of Osome's products and features, Gabi makes complex business finance and accounting topics easy to understand for small business owners.

Get expert tips and business insights

Advice on starting and growing your company, as told by Osome's business community

For Singaporean citizens and permanent residents, the tax ID is the same as the National Registration Identity Card (NRIC) number. However, for foreigners working or residing in Singapore, the tax ID corresponds to their Foreign Identification Number (FIN).

In Singapore, the tax identifying number for individuals is the NRIC number, which is considered the Tax Reference Number (TRN).

To get a tax ID number in Singapore, you can register on the SingPass website or apply for an IRAS Unique Account, which is typically required for foreigners. This process is overseen by the IRAS and to complete the application, the system will require you to submit your National Registration Identity card.

You can check your TIN number in Malaysia by logging in to the MyTax website using your NRIC and password, or by visiting the https://mytax.hasil.gov.my/ website and selecting the "e-Daftar" option. This will display your registered income tax number and LHDN branch details.

If you are a Singapore citizen or permanent resident, your tax identification number is your IC. For non-Singapore citizens and permanent residents, you can find your tax identification number on your tax returns or work pass/immigration pass. Note that the use of foreign TINs is not allowed for tax purposes in Singapore.